This is why LEI codes are so important

If you don't know what an LEI code is or why it's important, please read this article.

The global LEI system emerged after the financial crisis of 2008 when the financial markets crashed. In a bid to ensure that this would not happen again, the G20 countries sent a request to the Financial Stability Board (FSA) for a system that would increase the transparency and stability of the financial markets. Today, the LEI system plays a major role in risk management and the management of fraud in the financial markets.

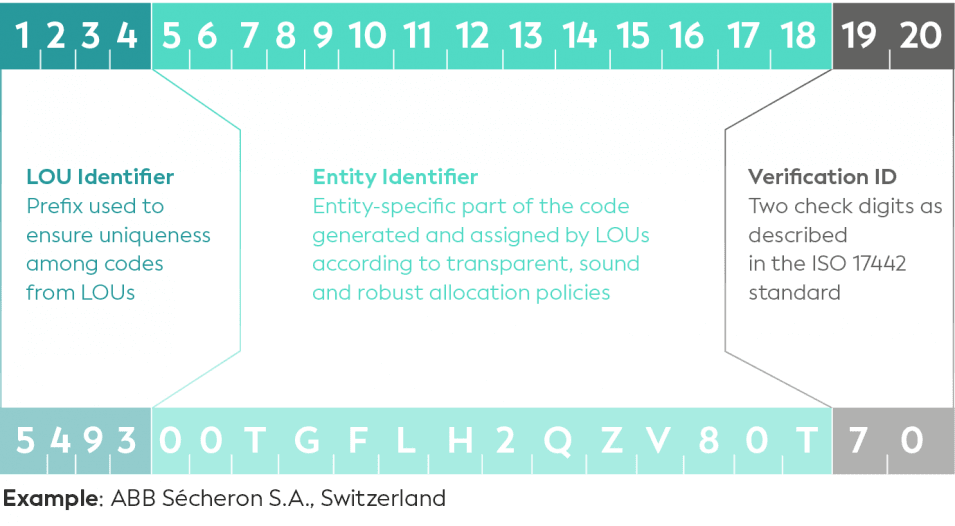

Companies that trade in securities must have an LEI code. An LEI code is a unique alphanumeric code consisting of 20 characters. The numbers 1-4 tell which Local Operating Unit (LOU) issued the code. Characters 5-18 consist of digits and letters that identify the individual legal entity and are unique to each individual company. The last two characters (19-20) are used for verification.

It used to require a lot of manual work to identify a trade - and the validation and identification was based on information from unreliable sources.

Due to the creation of the global LEI system, it is now possible to uniquely identify all companies and other legal entities participating in financial transactions. As such, the LEI system constitutes an important foundation for the security of the financial markets and the reliability of consumers operating in the financial markets.

Everyone has access to the LEI Search database at GLEIF, where you can look up any and all legal entities with an LEI code. Here you will find the following information about the company:

All LEI codes must be renewed once a year to ensure that the company data is up-to-date and correct. This increases transparency in the markets and makes it possible to reduce fraud by being able to identify both national and international financial transactions.

For several decades, there has been a need for a system to identify transactions on the financial markets across national borders. However, this has been difficult to create. In the wake of the world economic crisis in 2008, the G20 countries sent a request to the Financial Stability Board (FSB) for a system that could help restore trust between consumers and the financial markets. In 2012, the RFS responded to the G20 countries' request with a report containing principles and developments for a global LEI system. This was approved by the G20 countries at the summit in June 2012.

The report described how the system can improve risk management in companies through better assessment of micro- and macro-risks, reduce market abuse and financial fraud, while at the same time contribute to a higher quality of financial data across countries.

The requirement to be able to present an LEI code started for companies under the European Market Infrastructure Regulation (EMIR), which was the starting point for the LEI system. According to EMIR, all counterparties had to have a so-called "pre-LEI code". This was rolled out to ensure a smooth transition to the later MiFIR and MiFID II legislation.

In May 2014, new requirements came out when the MIFID directive came into force. This legislation focuses on increasing investor protection and increasing trading transparency by making the financial markets more robust, efficient, and transparent. Among other things, this directive contains authorization requirements for regulated markets, specific rules for the access of financial instruments to trading, and rules on specific behaviour and organizational requirements for investment companies.

On 1 January 2018, the MiFIR regulation and the MIFID II directive came into force, which meant that all companies had to have an LEI code before buying and selling securities. According to the legislation, it is the securities traders who must be able to report LEI codes on both parties in all transactions. This is when the LEI system really took off and became a new global standard.

Today, the LEI system has become a mainstay in the world of finance. Its applications are ever-growing, and it is expected that LEI codes will be required for cross-border payments in 2027. As an early adopter of the legislation in 2021, India experienced a 308% increase in the acquisition of LEIs over a two-year period. You can read more in our article, ‘LEIs required for cross-border payment transfers.’

LEI codes also plays a major role in the work around Know Your Customer (KYC), as they simplify the identification process and provides relevant and important information about the background of all legal entities participating in transactions. This opens up new business opportunities and increases operational efficiency for many large financial firms.

Please contact us here, if you have any questions or need help registering, renewing or transferring your LEI code.

If you don't know what an LEI code is or why it's important, please read this article.

The Global Legal Entities Identifier Foundation (GLEIF) is making waves in the world of digital trust and identity verification.

Our search function is user-friendly and lets you search for all global LEI codes.

We are here to help you!