The cheapest LEI code is not the best - and here's why

What do you get for your money when you buy an LEI code?

All legal entities wanting to trade in securities, such as shares, bonds and certificates, or carry out other financial transactions, must have an LEI code. LEI is short for Legal Entity Identifier.

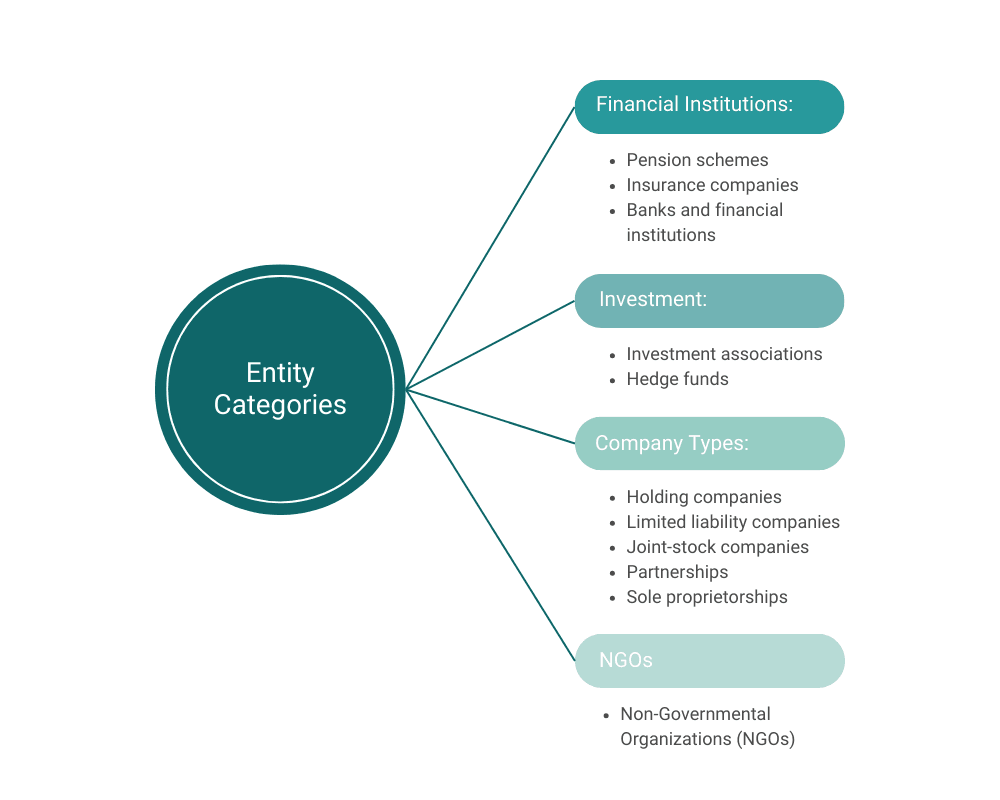

Legal entities are defined as all forms of businesses, including companies, associations, and foundations. An LEI code consists of 20 characters and is an alphanumeric code used to identify the entity in question. All LEI codes appear in a searchable database at GLEIF (Global Legal Entity Identifier Foundation).

GLEIF is a non-profit organization responsible for the implementation and utilization of the global LEI system. The organization has its headquarters in Switzerland. GLEIF are responsible for the accreditation of LEI providers (LOUs) so that they can officially issue LEI codes to their customers.

Practically all business types and organizations need an LEI code. The list includes, but is not limited to:

It is not a requirement for private individuals who carry put financial transactions to purchase an LEI code. If you don’t know whether you need an LEI code, you should ask your bank or investment firm. You are also welcome to contact our customer service.

An LEI code contains important details about the entity dealing in securities. An LEI code entails information on the entity's ownership structure, so it is possible to identify

In the EU, it is a legal requirement to have an LEI code as a result of the MiFID II directive that came into force in 2018. MiFID II is a regulatory framework designed to regulate and standardize financial markets. The purpose of MiFID II is thus to increase transparency and security in the financial markets. LEI codes have many functions and can be used, among other things, in the fight against money laundering.

There are many providers of LEI codes globally. We recommend that you choose an LEI provider that is familiar with local legislation and company structures. At Global FinReg, we are connected to the local business registries in a number of countries. We tap into these registries to retrieve your company information directly. This way, you know that your LEI code is always valid and up-to-date. If you have any questions or need help, our English-speaking customer service team is ready to assist you.

Before you pick an LEI provider, you should do a quick background check. Spend a moment on checking the provider’s credentials and finances. Are they endorsed by third parties, have they been around for a while, and do they run a profitable business? You can also try calling them to make sure they are who they say they are.

You can read more about how to pick an LEI provider in our article, ‘The cheapest LEI code isn’t the best - and here’s why’.

To summarize, all legal entities that carry out financial transactions must have an LEI code. This pertains to any company regardless of size or the type of company. Only private individuals are exempt from the requirement to have an LEI code.

From our offices in Copenhagen in Denmark, we offer a service that makes it quick and easy for you to get an LEI code. We care deeply about your privacy, so you may feel completely safe when registering as a user on our website. We automatically obtain your company information through the correct business registry and issue your LEI code within 1-2 working days.

From our offices in Copenhagen in Denmark, we offer a service that makes it quick and easy for you to get an LEI code. We care deeply about your privacy, so you may feel completely safe when registering as a user on our website. We automatically obtain your company information through the correct business registry and issue your LEI code within 1-2 working days.

Once your company has been assigned an LEI code, the code will be associated with the entity for the rest of its existence. As long as your LEI code is managed by us, we continuously update your information so it’s always correctly registered with GLEIF. An LEI code must be renewed every year to ensure that the information is correct and up to date. You can save money, if you buy an LEI code with a validity period of 3 or 5 years. You can see the prices for the different validity periods here.

What do you get for your money when you buy an LEI code?

The LEI system makes it possible to uniquely identify legal entities and their financial transactions.

How the LEI system is used in the fight against money laundering

We are here to help you!