Global FinReg enters into partnership with Concordium

Global FinReg becomes corporate identity provider for Concordium Blockchain

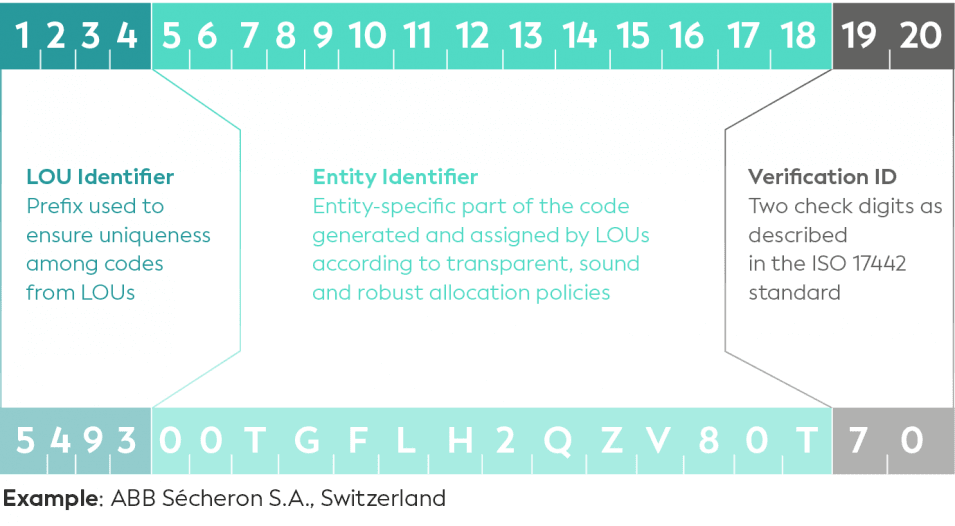

A Legal Entity Identifier is known as an LEI number or LEI code. It is a 20-character, alpha-numeric code, which makes it possible to clearly and uniquely identify legal entities that participate in financial transactions, i.e., buying or selling stocks, bonds, and other securities. (The term ‘legal entities’ includes companies, associations, foundations, and endowments.)

"It is required by law for legal entities engaging in financial transactions to have an LEI number. In short, this means that you can’t trade or deal in securities unless you have an LEI number."

As each LEI number contains information about an entity’s ownership structure, it tells you exactly 'who is who’ and ‘who owns whom’. This increases transparency in the global marketplace.

It is required by law for legal entities engaging in financial transactions to have an LEI number. In short, this means that you can’t trade or deal in securities unless you have an LEI number.

It is easy and fast to get an LEI number. You can get one right here.

If you need help picking the right LEI provider, please read our article, ‘The cheapest LEI code is not the best - and here’s why.’

The global LEI system is overseen by the Global Legal Entity Identifier Foundation (GLEIF). GLEIF is responsible for supporting the implementation and usage of the global LEI system.

GLEIF is a not-for-profit organization headquartered in Basel, Switzerland. The organization was established by the Financial Stability Board in June 2014.

GLEIF maintains the global directory known as the Global LEI Index where you can look up all global LEI numbers. GLEIF also accredits the Local Operating Units (LOUs) responsible for issuing LEI numbers.

The Legal Entity Identifier (LEI) is comparable to a global business registry number. It consists of 20 characters and is an alphanumeric code based on the global ISO 17442:2012 standard.

An LEI number contains information popularly referred to as ‘Level 1’ and ‘Level 2’ data. Briefly put, ‘Level 1’ data answers the question, ‘who is who’, and includes the official name of a legal entity and its registered address.

‘Level 2’ data answers the question, ‘who owns whom’, by identifying the direct accounting and ultimate accounting parent information.

For more information on the identification of legal entities via LEI codes, please read our article, ‘We provide accurate LEI data for the identification of legal entities via LEI codes’.

The Global LEI system came into existence on account of a request from the G20 countries to the Financial Stability Board (FSB) after the financial crisis in 2008.

As per GLEIF, “the FSB has reiterated that global LEI adoption underpins “multiple financial stability objectives” such as improved risk management in firms as well as better assessment of micro and macro-prudential risks. As a result, it promotes market integrity while containing market abuse and financial fraud. Also, LEI rollout “supports higher quality and accuracy of financial data overall”.”

In short, this means that the LEI system helps ensure transparency and stability in the global financial markets.

The benefits of the Legal Entity Identifier (LEI) system have grown with its widespread use and adoption. Today, the LEI system is used for multiple purposes and plays an important role in customer due diligence, anti-money laundering (AML), and the workaround Know Your Customer (KYC). You can listen to our podcast for more information about AML and KYC, or read more about it here.

The LEI system is still under development. You can find an overview of the current and proposed regulatory LEI activities at GLEIF by clicking here.

If you want to know more about the history of the LEI code, please read our article ‘The system behind LEI codes and its enormous potential’.

Global FinReg becomes corporate identity provider for Concordium Blockchain

Learn more about using LEI codes in relation to the banking world

If you need a LEI code right away, you can use our Express LEI Service. It's easy, fast and secure - and we do all the work for you.

We are here to help you!